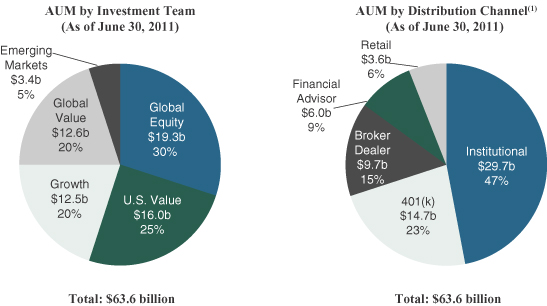

Those two trends shaped the firm's growth strategy. At the time, the Zieglers identified two secular trends-talent acquisition and open architecture-that were taking hold in the market. The foundation of Artisan Partners' story was set in 1994 by our founders Andy and Carlene Ziegler. To read this article on click here.Artisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies in growing asset classes to sophisticated clients around the world.

#Artisan partners aum free

Click to get this free reportĪrtisan Partners Asset Management Inc.

#Artisan partners aum download

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. We expect a below average return from the stock in the next few months. It's no surprise Artisan Partners has a Zacks Rank #4 (Sell). If you aren't focused on one strategy, this score is the one you should be interested in.Įstimates have been broadly trending downward for the stock, and the magnitude of this revision indicates a downward shift. Overall, the stock has an aggregate VGM Score of C. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy. In the past month, investors have witnessed a downward trend in fresh estimates.Īt this time, Artisan Partners has a subpar Growth Score of D, however its Momentum Score is doing a bit better with a C. How Have Estimates Been Moving Since Then? The company’s debt leverage ratio, calculated in accordance with its loan agreements, was 0.3 as of Dec 31, 2021. The operating income was $137.8 million, up 21.4% year over year.Ĭash and cash equivalents were $189.2 million compared with $155 million as of Dec 31, 2020. The rise was primarily due to higher incentive compensation, compensation and benefits, and travel expenses. Total operating expenses amounted to $177.2 million, up 20% year over year. Management fees earned from Separate accounts grew 15.3% to $116 million. Management fees earned from the Artisan Funds & Artisan Global Funds rose 25% year over year to $196.9 million. The top line surpassed the Zacks Consensus Estimate of $313.4 million. The rise primarily resulted from a higher average AUM balance. Also, the top line met the consensus estimate of $1.23 billion.įourth-quarter revenues were $315 million, rising 20.6% from the year-ago quarter. In 2021, total revenues climbed 36.4% year over year to $1.23 billion. Net income available to common shareholders of $336.5 million increased from $212.6 million in 2020. In 2021, adjusted net income per adjusted share of $5.03 beat the consensus estimate of $4.99 and rose 51% year over year. Net income attributable to Artisan Partners (GAAP basis) was $84.6 million, up from $73.1 million. However, an increase in expenses was an undermining factor.

Results were supported by a rise in revenues and higher AUM. The bottom line soared from $1.06 in the year-ago quarter. Artisan Partners’ Q4 Earnings Beat Estimates, AUM RisesĪrtisan Partners’ fourth-quarter 2021 adjusted net income per adjusted share was $1.29, surpassing the Zacks Consensus Estimate of $1.25. Will the recent negative trend continue leading up to its next earnings release, or is Artisan Partners due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts. Shares have lost about 8.7% in that time frame, underperforming the S&P 500.

A month has gone by since the last earnings report for Artisan Partners Asset Management (APAM).

0 kommentar(er)

0 kommentar(er)